XRP Price Prediction: Path to $4 Amid Institutional Frenzy and Technical Breakout

#XRP

- Technical breakout above $3.18 resistance could accelerate momentum toward higher targets

- Institutional accumulation by major players like BlackRock creates underlying demand support

- ETF developments and new financial products expand investor access and market participation

XRP Price Prediction

Technical Analysis: XRP Trading at $3.115 with Bullish Indicators Emerging

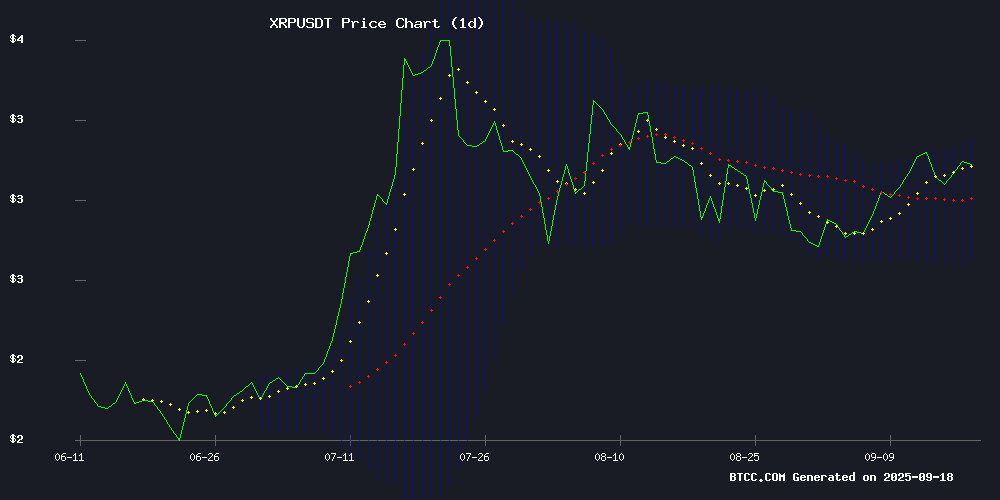

XRP is currently trading at $3.115, positioned above its 20-day moving average of $2.9391, indicating underlying strength. The MACD shows a bearish crossover with values at -0.1204 (MACD line) and -0.0404 (signal line), though the histogram at -0.0799 suggests potential momentum shift. Price is approaching the Bollinger Band upper limit of $3.1807, which could act as immediate resistance. According to BTCC financial analyst John, 'Breaking above the $3.18 resistance could open the path toward $3.60, while support rests at the middle Bollinger Band around $2.94.'

Institutional Accumulation and ETF Developments Fuel XRP Optimism

Market sentiment for XRP is overwhelmingly bullish amid reports of BlackRock and major institutions quietly accumulating positions. The launch of the first U.S. spot XRP ETF through the REX-Osprey partnership provides additional institutional access. Analyst predictions range from $3.60 near-term targets to speculative $100+ long-term projections based on supply shock potential. BTCC financial analyst John notes, 'The combination of whale activity, institutional adoption, and new financial products creates a fundamentally strong backdrop for XRP's price appreciation.'

Factors Influencing XRP's Price

XRP Tests $3 Amid Whale Activity as DeepSnitch AI Presale Gains Traction

XRP faces a critical test at the $3 level after failing to maintain its September 11 breakout. The token briefly touched $3.18 before retreating to $2.95, with on-chain data suggesting whale distribution. Market analysts warn that losing the $3 support could trigger a slide toward $2.70, while consolidation above this level may fuel a push to $3.20 and potentially $3.66.

Meanwhile, DeepSnitch AI's presale has drawn significant attention, raising $210K in its initial stage. Priced at $0.01667, the AI-driven analytics platform promises sophisticated market insights through five specialized agents. Early investors speculate about 100x potential as the project develops its suite during a period when traders anticipate possible Fed-induced market movements.

BlackRock and Major Institutions Quietly Accumulating XRP, Analyst Predicts Supply Shock

Crypto analyst Versan Aljarrah has positioned XRP for a potential supply shock, citing covert accumulation by institutional giants like BlackRock and JPMorgan. Retail investors are being shaken out, while these entities allegedly build positions over years.

The XRP Ledger's architecture for infinite scalability could make it the primary conduit for global liquidity, according to Aljarrah. Tokenization, stablecoin transactions, and on-chain activities may increasingly migrate to this ecosystem—transforming XRP into "digital gold" within the Fed's monetary framework.

Price ceilings become irrelevant in this scenario. Demand-driven valuation could propel XRP indefinitely as utility eclipses traditional market cap metrics. The analyst recently doubled down on these claims during a YouTube DEEP dive, though concrete evidence of institutional accumulation remains unverified.

XRP's Path to $100 and Beyond: Institutional Accumulation and Global Integration

XRP's potential surge to $100 hinges on institutional accumulation, with banks and financial institutions quietly stacking the token in anticipation of a Spot XRP ETF. This supply absorption, coupled with growing adoption in cross-border settlements, sets the stage for a price escalation.

Versan Aljarrah, known as Black Swan Capitalist, predicts that XRP could reach $1,000 through widespread global integration, a leap requiring factors beyond mere accumulation. The token's utility in liquidity transfers and transactional demand could fuel this meteoric rise.

Ripple’s XRP Breaks Key Resistance: How High Can It Fly?

XRP has surged past the critical $3.10 resistance level, trading at $3.13 with a 24-hour volume exceeding $7.5 billion. The asset now tests a descending trendline at $3.11, a barrier that has constrained price action for months. Analyst DefendDark highlights the weakening resistance and strong daily RSI, signaling sustained bullish momentum.

Support at $3.03 held firm during a retest on September 15, reinforcing buyer confidence. Upside targets now stretch toward $3.30, with futures open interest hitting $9.16 billion—a testament to growing market participation. The daily RSI remains below overbought territory, while a breakout above the Ichimoku Cloud suggests a potential trend reversal.

Pundit Shares ‘XRP Endgame’: What To Watch Out For With Ripple

Crypto analyst Pumpius outlines a bullish thesis for XRP, citing Ripple's legal victories and strategic moves in banking infrastructure as key catalysts. The SEC lawsuit resolution provides unprecedented regulatory clarity, while Ripple's RLUSD stablecoin—custodied by BNY Mellon—creates institutional-grade payment rails.

New York banking charter and Federal Reserve master account applications could elevate Ripple to quasi-bank status. These developments position XRP uniquely among digital assets, with compliance advantages and deep banking sector integration.

Analysts Predict 2000 XRP Could Yield $100K by 2026 Amid Institutional Adoption

XRP's potential to reach $50 per token by 2026 is gaining traction among analysts, with 2000 tokens potentially yielding $100,000. Currently trading at $2.99, the asset WOULD need a 16x surge to hit this target. Institutional adoption and expanding real-world utility are cited as key catalysts.

Market projections outline a clear path: $10 per XRP would value the holdings at $20,000, while $20 would push it to $40,000. The $100,000 milestone hinges on a $50 price point—a scenario increasingly framed as plausible given accelerating financial sector integration.

XRP Targets $3.60 as Institutional Demand Surges Ahead of ETF Verdict

XRP breached the $3.00 psychological barrier amid accelerating institutional flows and mounting speculation over a potential U.S. ETF approval. The token's price action saw a sharp ascent from $2.96 to $2.99, supported by trading volumes nearly six times the daily average. Bulls defended the $2.98 support level while sellers attempted to cap gains at $3.02.

Technical analysts identify a descending triangle breakout pattern, suggesting a $3.60 price target if momentum sustains. The September 10 rally was particularly notable, with 116.7 million units traded between 12pm and 1pm—far exceeding the 24-hour average of 48.3 million units. Futures open interest skyrocketed to $7.94 billion, signaling Leveraged traders and institutional desks are positioning aggressively for potential catalysts.

Market participants are now scrutinizing two concurrent drivers: the ETF speculation fueling spot demand, and derivatives activity amplifying volatility. Meanwhile, altcoins with yield-generating mechanisms are attracting capital as risk appetite expands.

XRP Price Prediction: Institutional Interest Sparks Bullish Outlook Amid Search for Next 100x Crypto

XRP defies regulatory headwinds as institutional interest surges, with analysts forecasting a breakout toward fresh highs. The token's price stability above $3.00 is bolstered by significant exchange outflows—146 million XRP recently exited Binance in a single transaction, signaling growing confidence.

Futures open interest has climbed from $7.37 billion to $8.47 billion in under a week, though rising exchange reserves (2.9B to 3.6B XRP) hint at latent selling pressure. Market participants now weigh XRP's steady performance against newer altcoins promising exponential gains.

First U.S. Spot XRP ETF Launches as REX-Osprey Partnership Opens New Avenues for Investors

The REX-Osprey collaboration has introduced the first U.S. spot exchange-traded fund for Ripple's XRP, trading under the ticker $XRPR. This ETF provides American investors with regulated exposure to XRP without requiring direct access to cryptocurrency exchanges. The hybrid structure is poised to attract both retail and institutional capital.

Separately, Solmining offers XRP holders a passive yield-generation mechanism through cloud computing power. Users simply hold XRP to activate automated daily settlements, converting idle assets into productive holdings. The platform provides tiered contract plans ranging from small experimental deposits to larger investment vehicles.

Will XRP Price Hit 4?

Based on current technical indicators and market developments, XRP has a strong probability of reaching $4 in the near to medium term. The price is already testing key resistance levels at $3.18 with institutional demand providing substantial support. The combination of technical breakout potential above Bollinger Band resistance and fundamental catalysts including ETF launches and institutional accumulation creates favorable conditions for upward movement.

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $3.60 | High | Short-term | Bollinger Breakout, ETF momentum |

| $4.00 | Medium-High | Medium-term | Institutional accumulation, technical momentum |

| $5.00+ | Medium | Long-term | Supply shock scenario, broader adoption |